Individuals and business concerns, whether it is small (including start-up concerns), medium, or large organizations registering under GST are assigned with a unique identification number known as GSTIN (GST Identification Number), or simply called a GST Number. Earlier you have a TIN number which was allotted by state authorizes to the business entitles, it is now replaced by the GSTIN national wide. One of the best benefit of the getting your GST registration done is you can use it across the country anywhere to carry out your business. Gst registration can be done online through government website gst.gov.in. Every business owner whose annual turnover exceeds Rs.20 lakhs as may vary depending upon state and kind of supplies has to register for GST. It is mandatory for certain businesses to complete the GST registration process. Carrying out the business operations without GST registration is considered as a criminal offense and heavy penalties are levied for non-registration of the same.

You can get your GST registration done through online. You don’t need to have to send any hard copies just get scanned your vital documents as soft copies to get submitted for your online registration.

List of Documents Required for GST New Registration

Before you start filling the GST application form online, it is advised to be ready with the scanned copies of the documents listed below:

- A valid net banking details, such as bank account number, name of the account-holder, IFSC code, etc.

- Proof of constitution or incorporation of your business

- Deed of Partnership (in case your business has partners)

- Registration Certificate of the business entity

- Proof of primary place of business

- A passport size photo of the director, partner, promoter or the head member of the Hindu Undivided Family (HUF)

- Proof of appointment of Authorised Signatory

- A passport size photo of the Authorised Signatory

- A scanned copy of the bank passbook (either front or first page) or bank statement which contains the required information, such as bank account number, account holder’s name, address, latest transaction details, etc.

Once you have the scanned copies of all the pre-required documents stated above, you may proceed with filling the online GST Application form for all the given tabs on your Dashboard.

Steps to be followed to get your GST registration done through online.

As first step open a web browser and go to the website https://gst.gov.in. This is the official website/portal of the government of India Goods and Services Tax (GST) to register. You can access the website from your desktop PC, laptop, tablet or smartphone with an active Internet connection.

GST Registration Application page is divided into two parts, namely Part A and Part B which has to be filled.

In the GST portal, click the Services menu at the top, click on the Registration link and click again on the New Registration option. You will be redirected automatically to the GST Registration page to complete the online registration process.

Enter the following details in Part A –

- Select New Registration radio button

- In the drop-down under ‘I am a’ – select Taxpayer

- Select State and District from the drop down

- Fill in the Name of Business and PAN of the business

- Provide the Email Address and Mobile Number. The registered email id and mobile number will receive the OTPs.

- Enter the given captcha and Click on Proceed

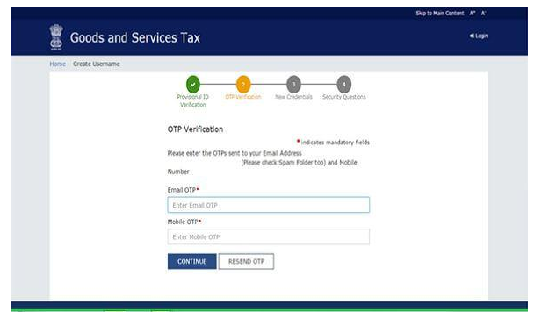

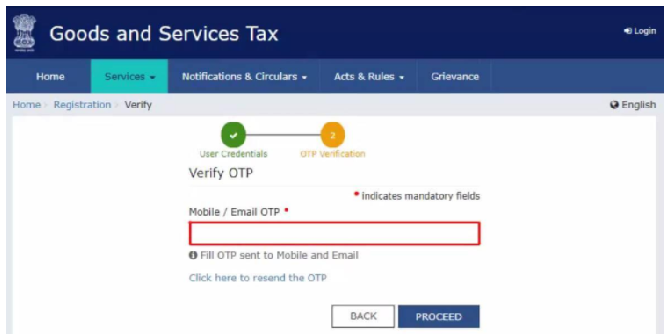

Once you receive the OTP through mobile and email enter the OTP. Click on Continue. If you have not received the OTP click on Resend OTP.

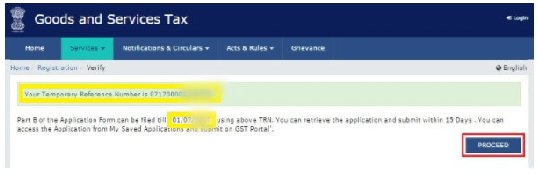

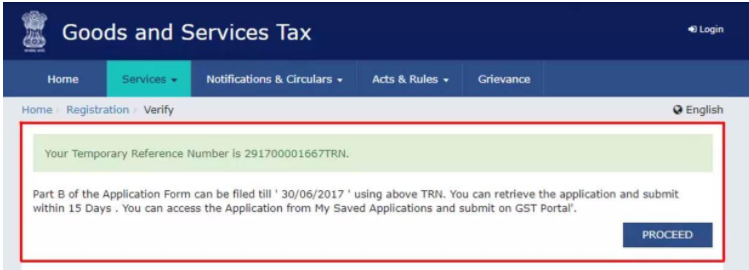

15-digit Temporary Reference Number (TRN) is received. After the OTP Verification process is completed successfully. The system will automatically generate a Temporary Reference Number (TRN) This TRN is sent to email and mobile too. Note down the TRN. You need to complete filling the part-B details within the next 15 days.

Click the Proceed button again and you will be redirected to the New Registration page again, where you must ensure that you selected the Temporary Reference Number (TRN) option at the top. Enter the TRN and the captcha code and click on Proceed.

You will receive an OTP on the registered mobile and email. Enter the OTP and click on Proceed

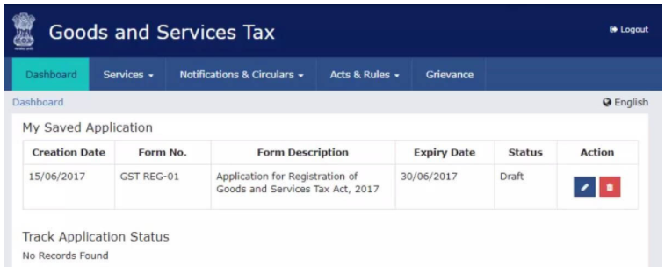

You will see that the status of the application is shown as drafts. Click on Edit Icon.

Steps to complete GST registration application Part-B:

Part B has about 10 sections such as business details, Aaadhar authentication, etc that has to be filled and submitted with the essential documents.

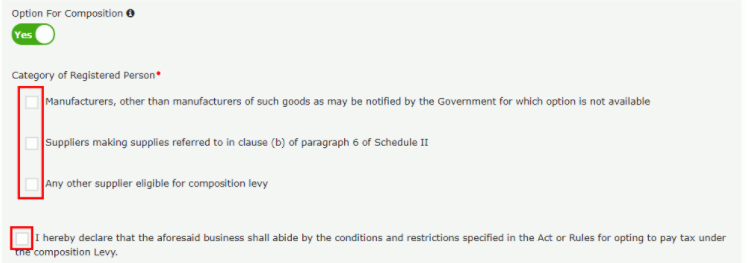

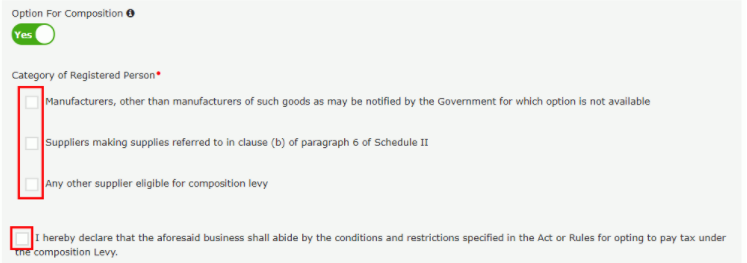

In the Business Details section, you need to provide the information like the trade name, business constitution and district. Here the Trade name and the legal name of the business is entirely different. select ‘Yes/No’ to opt-in or out of the composition scheme, against the field- “Option for Composition”. Further, choose the type of registered person as manufacturers or service providers of work contract or any other person eligible for composition scheme.

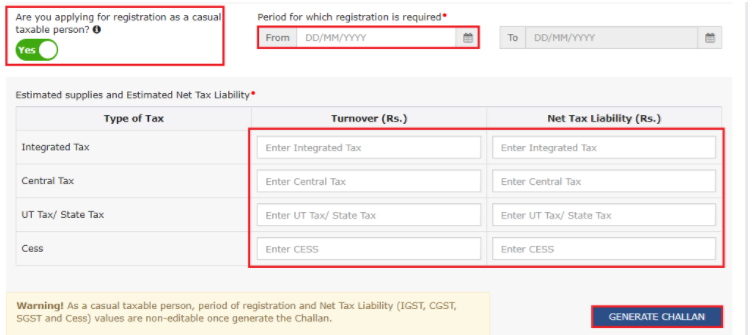

Then enter the date from when you started the business and date from which liability arises. Also, select ‘Yes/No’ for type of registration as a casual taxable person and if ‘Yes’ is chosen, then generate the challan by entering the details for advance tax payment as per the GST law for casual taxable persons.

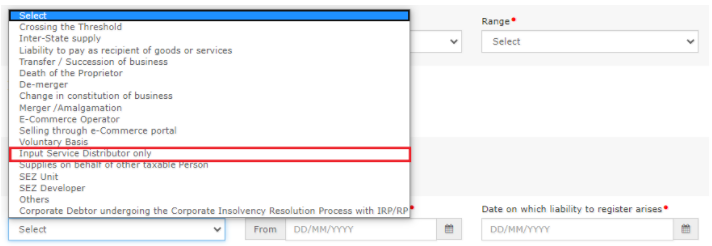

In the field asking for the ‘Reason to obtain registration, select the reason from the many other options are available to choose.

According to the reason selected, you need to enter details in the fields that appear, like name, designation of approving authority, approval order number, etc. and upload the supporting documents.

In the Indicate Existing Registrations section, choose the type of existing registration such as Central Sales Tax, Excise or Service Tax, registration number and date of registration. And, click the ‘Add’ button.

After entering the details are entered, you can find that the tile colour turns to blue which indicates the completion of filling up details in that section.

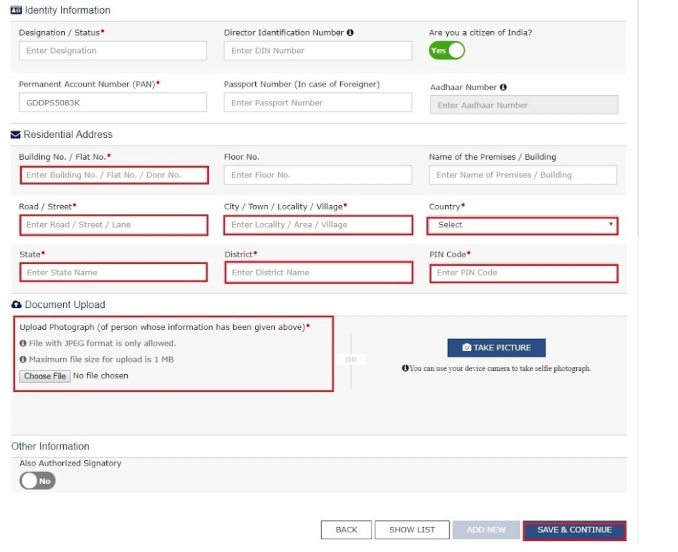

In the Promoters/Partners tab, you need to key in the details of up to 10 Promoters or Partners such as their name, address, mobile number, date of birth, email address and gender and identity details such as Designation / Status and Director Identification Number if the taxpayer is a company, whether or not an Indian citizen, PAN and Aadhaar numbers must all be entered.

Fill in the residential address and upload a photograph. Maximum file size for upload of photograph is 1 MB in pdf or jpeg format.

If the promoter is also the primary authorised signatory, then make the necessary selection. Click on the ‘SAVE & CONTINUE’ button to proceed.

In the Authorised signatory tab, enter the personal details of the promoters or partners.

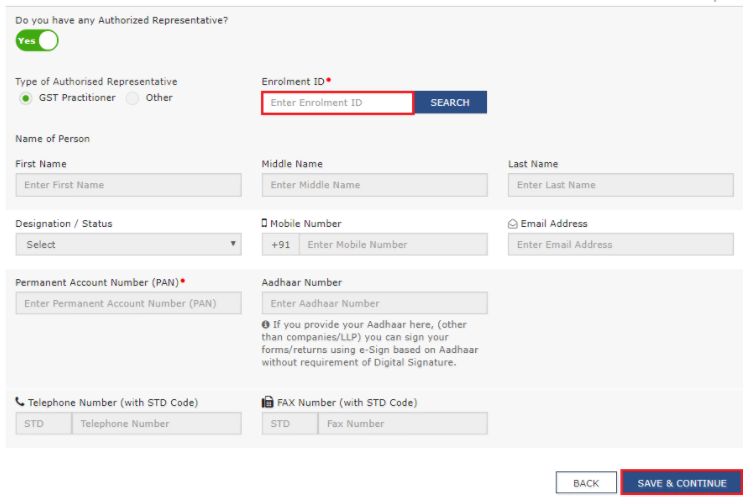

And the next tab is authorized representative. If you are a GST practitioner, enter the enrollment ID and in case of authorised representative, enter basic details in the given fields.

The next tab is to give details about Principal Place of Business. You need to give details regarding the place of business where it is operated from, where its accounts were maintained and managed. You also need to give the address, district, sector/circle/ward/charge/unit, commissionerate code, division code and range code. You need to submit some documents like rental agreements, NOC for the premises where the business is carried out. After entering all the details click the ‘save and continue’ button.

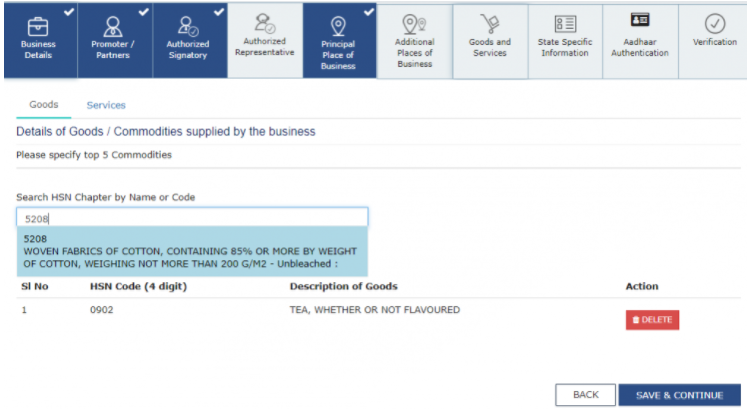

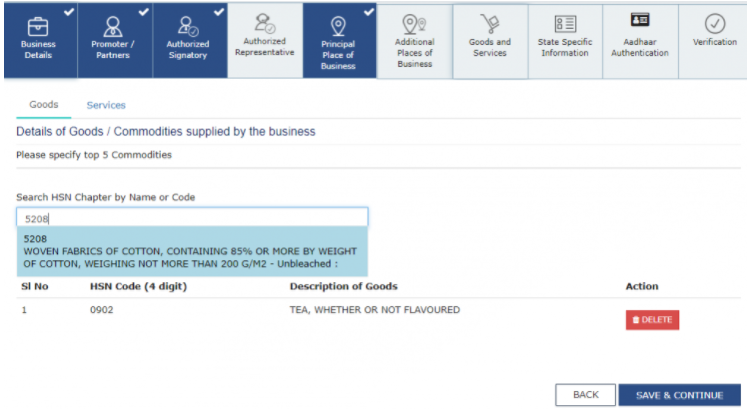

If you have any additional places where the business is carries out you need to submit the details in the next tab. The next tab is to enter the details regarding goods and services along with the HSN codes or SAC.

Other tabs you need to provide bank account details, in the next tab, you need to key in details of the professional tax employee code number, PT registration certificate number and State Excise License number with the name holding the license. And the next step is aadhar authentication, where you need to submit the aadhar authentication of the business holder.

After the completion of entering all the details, you will be directed to the verification page, tick on the declaration and submit the application using any of the following ways:

- Companies and LLPs must submit application using DSC

- Using e-Sign – OTP will be sent to Aadhaar registered number

- Using EVC – OTP will be sent to the registered mobile.

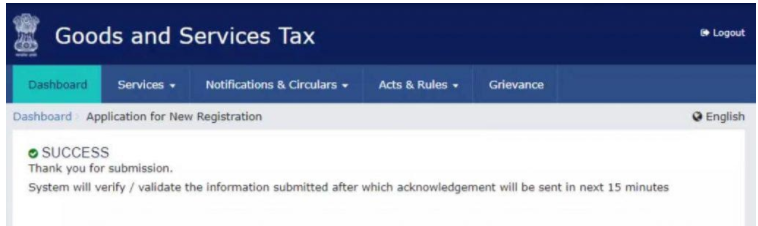

Application Reference Number (ARN) is sent to registered email and mobile after successfully submitting the application with all the details required. You can give your ARN number in the GST portal to check the status of your registration.